Care Two Share

- BizzNeeti

- Jul 9, 2020

- 9 min read

Before things started going haywire because of the dreadful Virus, in January of this year, an exciting development had taken place. Bounce had raised a remarkable $97 million in Series-D funding, led by B Capital - owned by Facebook co-founder Eduardo Saverin. Some of the biggest names, including Sequoia Capital and Accel Partners India, participated in that round.

According to a Paper.vc analyst, this might be the highest amount of funding any scooter company has ever raised. Bounce, whose valuation rose to $450 million, after the Series D funding round, had also raised $72 million Series C funding round, again led by B Capital and NY-based Falcon Edge Capital, in June 2019 (FRPT- Software Snapshot, p.25).

In this article, we try and dissect the shared mobility industry in India, focussing on the two-wheeler segment (including e-scooters and hybrid cycles), with the key players being Bounce, Onn Bikes, Drivezy, Yulu, etc. We will also be seeing how the firms are trying to adapt to the current situation and chart their paths forward.

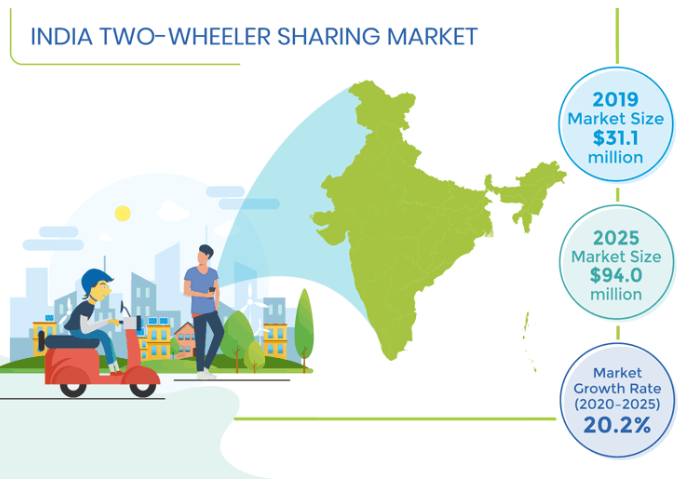

According to a PR Newswire report published on 10th April 2019, "The global shared mobility market is expected to reach an estimated $138.7 billion by 2023 with a CAGR of 15.2% from 2018 to 2023".

There are broadly three types of bike-sharing offerings that are available: rentals, clusters, and dockless.

In the rental mode, we rent a bike for a specified number of hours and then bring it back to its original location. In the clustered or zonal way, there are specific zones where the bike-sharing startups operate, and we could park the bike in one of those zones, and there's no need to bring it back to the starting location.

Dockless takes it a notch higher. This type of commute helps us reach one point from another (this need not be a specific zone), without having to take the help of any other person, which makes these services pretty convenient for those short distances when we get down at the bus stop, and instead of walking to the workplace, we could easily use these hybrid bikes. An e-scooter like Bounce also helps us travel relatively long distances with ease.

Bicycles have been India's favourite mode of transport for decades, especially in the rural and semi-urban areas. Even today, the milkmen or those distributing newspapers avail bicycles.

According to YourStory, as of 2018, the bicycle market in India was valued at $1.2billion with the production estimated to be at 15 million units!

This speaks "volumes" about the market size and potential of this industry. Motorisation had already slowed down the popularity of bicycles in the cities, but in the last couple of years, primarily to avoid road congestion, people have been increasingly using bikes. This trend has not gone unnoticed, though. Several startups have capitalized on this market inefficiency, facilitating the natural use of bicycles for the last mile transportation. Thus, a person can get down from a bus and then hop on a nearby dockless bike to reach their workplace.

Ola had introduced Ola Pedal way back in 2017, and the pilots being conducted in some of the college campuses in India, notably at the IITs at Kharagpur and Kanpur. During that time, Zoomcar had also launched PEDL, focusing mostly on Bangalore's HSR Layout and had later explored the markets in Chennai and Calcutta too. Mobycy launched with a $500 million seed funding, and Wheelstreet came up as well. However, the company that has taken this sector by storm is Yulu. An IoT based bike-sharing platform, Yulu has been co-founded by Amit Gupta. All the above-mentioned startups have heavily invested in new-gen technologies, including QR code scanning and easy integration with digital wallets.

...

Bounce (formerly known as Metro Bikes), Vogo, which is backed by Ola, and Onn Bikes are the major players in this sector. Mostly, they provide dockless services. All of them started with scooters and motorbikes that ran on fuel but are slowly expanding their e-scooter fleet. They are well integrated with IoT technologies to ensure the proper safety of their assets and streamlined logistics. Dockless will only work if there is a sizable number of scooters that are operating because otherwise, the consumers would have to walk to get to the nearest parked bike, which makes the whole dockless experience entirely pointless.

Bouncing Ahead

Bounce is one of the top players in the two-wheeler segment currently. For the founders Varun, Vivekananda, and Anil, this wasn't their first experience in this market. In 2014, they had started Wicked Rides, a premium bike rental service.

This was after Anil had to wait for about a year after placing an order for Royal Enfield. We are talking about a time when premium bikes were not available aplenty in India, and these kinds of timelines weren't unheard of.

They started Metro Bikes to alleviate the problems that commuters, especially in the populated urban centers face. Theirs was one of the first dockless services, in contrast to the docked and hub-based services that most shared mobility startups used to provide during that time. In August 2018, Metro Bikes raised $12.2 mn in their Series A funding round, which was led by Accel Partners and Sequoia Capital. This was also when they changed their brand name to Bounce. The Series A Funding Round was followed by a Series B in January 2019. Sequoia Capital, Mauritius Investments, Chiratae Ventures, and Accel India led this round. Then came the Series C and the very recent Series D funding rounds that we have talked about earlier in this article.

The patented keyless technology that Bounce had come up with has led to its massive popularity, especially amongst the youth in Bengaluru. This technology makes the whole dockless experience multifold times smoother, as people can quickly pick up and drop their vehicles using an OTP, which also helps Bounce maintain the security of not only their assets but also their users.

After their Series A, the company had targeted scaling their operations in Bengaluru and expanding pan-India by 2020. While they have been successful in scaling up their operations in Bengaluru, whereby July last year they had reached several significant milestones: 7,000 dockless two-wheelers, 60,000 rides per day (in Bengaluru) and 1.1 million users. But beyond Bengaluru, Hyderabad is the only other metro they have been able to expand their operations to. With COVID-related sectoral uncertainties, and having decided to let go of 22% of its total workforce as recently as last week, they are surely re-strategizing their operations.

In fact, from last year itself, Bounce had been trying to replace the fuel vehicles in their fleet with electric two-wheelers. They are tapping into the Indian-based electric vehicle OEMs, such as Okinawa, Ampere, and Ather.

These two-wheelers are then being retrofitted with IoT devices and screens for easy navigation, are being made keyless and their sturdiness tested in the labs. However, it's difficult for these electric scooters to be made totally dockless, as that would require charging stations to be built throughout the city (in this case, Bengaluru). Bounce is also using repurposed fuel vehicles in the towns and tier-2 towns they operate in. While the initial investment for setting up an electric infrastructure is quite high, Bounce has realized that it would not only be environment-friendly but would also be futuristic and ensure cost savings in the long run. They would also be well placed when a few years down the line, the government actually decides to limit the number of fuel vehicles being produced.

Bounce is also working on its electric scooter - the NN310, slated to cover >60km on a single charge.

Covid-19 has unarguably hit the sector quite hard. During the first month of the lockdown, these vehicles could not even operate. There have been layoffs and pay cuts, and it has not been different for Bounce. Bounce got into partnerships with those providing essential delivery services, including Zomato, Swiggy, BigBasket, etc. and had offered the bikes from their fleet. The tie-up with DriveU was quite an innovative move as, in this case, they provided their underutilized fleet to the driver-partners at DriveU, enabling them to carry out essential services and keep the ball rolling.

Finally, in response to the current crisis and to try and turn it into an opportunity, they have introduced another offering which they've named Bounce-A, where A stands for “Aatmnirbhar”, inspired by PM Modi's clarion call for a self-reliant India.

They are going for a lease-to-own model, where instead of buying the two-wheelers from the dealers, customers, especially those who do not want to make significant investments, would lease them from Bounce. Bounce has also tied up with NBFCs and banks for easy financing options for the consumers. Such a step might be the thing people need in a post COVID world that would ensure proper health, safety and social distancing, and at the same time would mean less investment than it would if the customers were to buy the same two-wheelers.

This also means a shift from their original business model and a lot of capital investment. Apart from competing against ONN, Yulu (backed by Uber), Vogo (backed by Ola), Bounce would also have to worry about the dealerships they would be in direct conflict with if they go forward with this in the long haul. There is also a risk of stretching themselves too thin.

...

‘Cause, YULU!

In March 2019, in a sudden move, Uber announced a tie-up with a UMaaS (Urban Mobility as a Service) provider, Yulu. It redirects a user to register on the Yulu website, in the cities the shared two-wheeler service operates in. This opened Yulu to the huge customer base that comes with Uber, be it in any city. The tie-up was also preceded by Uber acquiring Jump, an e-scooter startup based out of NY.

In August 2017, Yulu was co-founded by Amit Gupta, Hemant Gupta, Naveen Dachuri, and RK Misra, all of them seasoned entrepreneurs. Amit Gupta is also the co-founder of InMobi, the famed marketing tech company.

Having seen the success of shared two-wheeler startups, such as Ofo and Mobike in China, Amit was certain this would go a long way in helping solve India’s transportation problems in the urban centers.

Their seed funding round was in July 2018, where they raised $7 million, with the participating investors being Wavemaker Partners, Incubate Fund, Blume Ventures, AET Fund, and 3one4 Capital.

This was followed by three Series A rounds, in November 2019, February 2020, and June 2020, raising a total of about $13 million. Bajaj Auto Finance, Wavemaker Partners, and rocketship.vc were the investors in these rounds.

Yulu started with dockless bicycles, called Move, in Bengaluru. Powered by Bluetooth, GPS, and GPRS, Move is a convenient last mile/micro-mobility option. Maintaining battery levels is a very fundamental challenge for startups operating in this domain. Yulu has formed its own network of chargers which they use to remotely rejuvenate the batteries and then replace discharged ones from the bicycles. They have tied up with the kirana stores against monthly payments to leverage their spread across the city to place charging boxes and ease logistical challenges.

Yulu has also brought in a new fleet, called the Miracle, which are hybrid electric bikes. According to their website, it is “lighter than a scooter, but faster than a bicycle”. They source these parts from China, which are then assembled by a local vendor. Going forward, Bajaj Auto is expected to be developing the bikes for Yulu, at a lower cost than the Chinese OEMs. The Miracle is fitted with an IoT technology and the ride can be started and stopped by scanning QR Code in the Yulu App.

Having said that, Yulu also had to face a lot of theft and damage to its assets. This is the major reason they shifted to a cluster-based approach from a dockless one, last July.

There are Yulu zones where people can pick up and drop off the vehicle, and these zones come with charging stations and battery swapping facilities.

Yulu has been able to expand its network to Mumbai and Delhi, although the number of takers is relatively less than that in Bengaluru. One of the major drawbacks of both Move and Miracle is that it becomes quite unsafe to ride these vehicles in normal traffic lanes.

To ensure safety for the riders in the current times, Yulu has been following WHO-recommended sanitisation guidelines and in a great move, has been showing the last sanitized timestamp to their users, being probably the only company to do so.

...

It’s been quite a while that the shared mobility concept has been introduced in India, however, only in the last two years has it gained some amount of popularity, especially with some of the big VC names investing in it. The popularity has, however, been quite localised and has not yet reached quite a few metros as well.

Adding to the behavioural difficulties, we have got the logistics-related challenges. Theft and damages are quite common phenomena that are related to this sector globally, and the Indian firms have not been left unscathed. For that, they would have to forge relationships with the securities in the societies and the corporate parks and would also need administrative support.

With Non-Motorised Tracks (NMTs) becoming essential for the users to ride these bikes seamlessly, government support is needed to build those NMTs. While pollution control and decongestion of the urban centres would become imperative in the coming days, introducing, and supporting more such startups might make that task a whole lot easier. These startups would also complement the government’s increased focus on smart cities and can be easily integrated into their planning.

Having said all that, we do not know by how much will the behaviour of the people change post-COVID, but for all we know, these bikes have a tremendous advantage in that they require minimal human contact. While indirect contact is there, but that can be taken care of by proper sanitisation and even on-demand sanitisation.

Will people want to use a greater number of private vehicles? Definitely, yes. Would they want to make such significant investments? Maybe, no. The Yulus, the Vogos and the Bounces then might come to the rescue.

Lastly, when the pandemic subsides, we will need to start thinking about addressing the environmental concerns, and increased adoption of such modes of transport leading to less reliance on public transport might just be the way forward.

Informative and precise. 👏🏽