Mudrex and a Vital Lesson for Entrepreneurs

- BizzNeeti

- Nov 12, 2019

- 4 min read

Origin

Mudrex was originally supposed to be launched as a cryptocurrency exchange platform on 15th April, 2018. However, as luck would have it, the RBI released a circular prohibiting all entities which are regulated by RBI are prohibited from "providing any service in relation to virtual currencies, including those of transfer or receipt of money in accounts relating to the purchase or sale of virtual currencies", as they were wary of the potential financial, operational, legal and security related risks that the users, holders and traders of virtual currencies were exposing themselves to.

Dejected, the Mudrex team consisting of five IIT-ians, had to back out as they didn’t deem setting up a crypto exchange to be a practicable proposition anymore. Even though this was a big blow as they had put in years of hard work, they didn’t lose heart and went back to the ‘drawing board’, brainstormed and came up with the idea that helped revamp the platform.

While trading crypto themselves, they realised that it’s a stressful activity: because of the transitory and dynamic nature of the crypto market which, unlike the stock market, is active 24*7 and also because of crypto trading being a global activity, with about 300-400 exchanges operating in a single country itself.

They wanted to make this experience a ‘stress-free’ one for the traders. Around May, they came up with THE idea, an epiphany of sorts - automation of crypto trading.

But there is a catch to it.

Now, automation of crypto trading, better known as algorithmic trading, has been around for quite some time now, and is used to generate optimum profits at higher frequency. Computer programming is used to execute trades automatically, based on algorithms, or user-defined sets of rules. While it has certain advantages, which include high speed, backtesting ability (testing algorithms using historical data), and minimum human intervention, there are disadvantages too. A few investors might face problems as implementing a strategy and getting an algorithm up and running would require them to have programming skills as well as deep knowledge of trading and finance. Another disadvantage is the high infrastructural cost involved.

Now, Mudrex aimed to democratise crypto trading - so that traders wouldn’t have to code to put their algorithms to use. This ensured that retail investors, who are not adept at programming, would not lose out on much and would be able to see their trading ideas find fruition. What Mudrex was successful at doing is create a level playing field for the ‘Haves’ and the ‘Have Nots’, as described succinctly by Edul Patel (a co-founder of Mudrex).

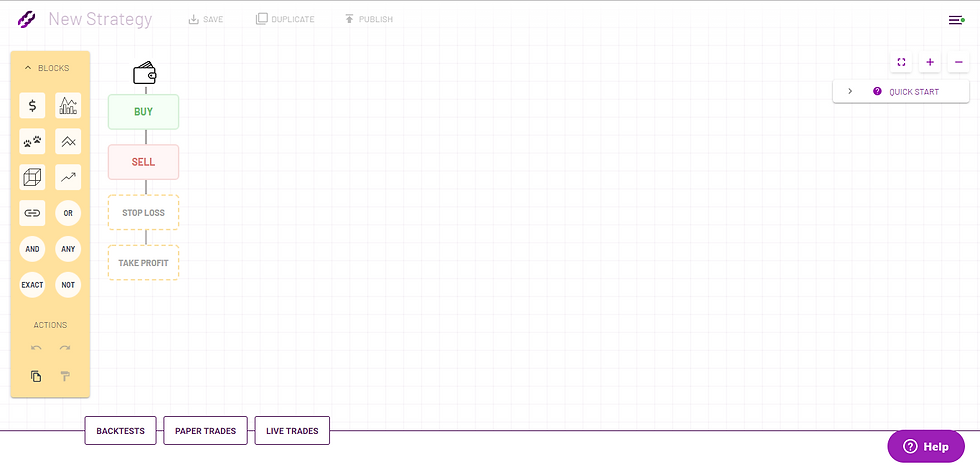

The former has the infrastructural and technological capability to build and execute algorithms, and the latter doesn’t — and that’s exactly where Mudrex comes in. While the backend coding has been done by the expert Mudrex team, users would just have to build their strategies using simple Drag-and-Drop features, thus removing any programming intervention at their end.The fact that there is no programming requirement is also what actually distinguishes Mudrex from similar platforms, such as TradingView, Quantopian, etc.

Brass Tacks

While operating in a closed beta, that started six months after the RBI decision and continued till February 2019, the team tested the platform with 10-15 traders, after which they launched the platform to a wider, global audience. By February 2019, they had already onboarded more than 1000 users, with around 20%-30% being from India and the rest from the US and the South Asian countries. They maintain that they have been seeing around 25% week over week growth in trading volume since going live.

A part of the YCombinator’s Winter 2019 Batch, Mudrex was able to raise $150K in seed stage funding.

The platform contains the Mudrex Visual Strategy Editor, which is a Drag and Drop editor used to create strategies, and can also be integrated with a crypto exchange using API keys. It enables backtesting using historical data and trading using dummy monies.

For building a strategy, users need to take a few factors into account, namely, the asset and whether it is in the appropriate phase of the market cycle, exit point, entry point, the expected reward and the stop loss. Different kinds of indicators are used (example: Oscillating Indicators, Moving Average and the likes), identifying separate kinds of market conditions. A strategy is created by using a combination of indicators, such that it suits the user’s risk profile, the asset the user is interested in and the timeframe.

Executing a strategy involves polling data (extracting the OHLCV data from the exchanges per minute for every asset pair), start strategies, generating buy/sell signals, placing the orders, and fee deductions. The user also has the option to stop the strategy. The performance of the strategy can also be evaluated by measuring risk, return and risk adjusted return. Mudrex gives the user 23 different metrics for the purpose of evaluation of a strategy. Since its launch in February of this year, Mudrex has had users test using 25 years of backtesting data, and a trade volume of around five million USD.

The Marketplace, which lets anyone invest in top performing strategies created by pro traders, was launched in June 2019. Using the Marketplace, a user can:

Test the trading strategies on historical data before choosing to invest.

Invest directly from their own account by connecting their order only API keys from exchanges like Binance/Bitmex.

Go live by paying a flat monthly subscription fee.

Every strategy is verified by the Mudrex Review Council, and also tested for validity in the conditions as mentioned specifically by the creators. Transparency is also maintained and users can directly reach out to the creators.

Mudrex follows a subscription-based model that accounts for available candle time periods and the number of backtests, and collects monthly payments from users. The lowest subscription tier is free (will be unable to use the strategy in investing in this tier) and the whole platform will be free for the next two months.

While it has been a good start for the fintech startup, it remains to be seen how it can evolve and grow in a market which is still not open to the concept of cryptocurrency and crypto trading. Having said that, it is indeed a huge achievement: the journey from having to scrap their original plans to changing their business model to become relevant, has been nothing short of inspirational. With the right temperament and, most importantly, constant and relentless innovation, one can easily wade through socio-economic, political as well as policy changes. They have shown the budding entrepreneurs how to face challenges in their stride, think beyond the box and utilise all that to come up with something that’s a game-changer.

Comments